*This subsidy has ENDED*

EMPLOYMENT RETENTION PROGRAM (ERP)

What is Employment Retention Program (ERP)?

The Employment Retention Program (ERP) is an immediate financial assistance provided for employees who have been instructed to take no paid leave by their employers who are economically affected by Covid-19 pandemic.

Criteria of Employment Retention Program (ERP)

Eligibility Conditions

- All private sector employees including temporary employees who have registered and are contributing to EIS (Employment Insurance System).

- Limited to employees with monthly salary of RM4,000 and below.

- Employers who have implemented no-pay leave (30 days minimum) since 1 March 2020.

Period of Assistance

Between 1 to 6 months, depending on the No-Pay Leave notice issued by employers.

How to Apply?

Applications must be made by employers on behalf of their employees using Form EPRC-19, with effect from 20 March 2020. The Form EPRC-19 can be downloaded from https://www.perkeso.gov.my and email to [email protected].

Start from 13 April 2020, applications must submit the application through the website http://prihatin.perkeso.gov.my. Email application will no longer be accepted after 13 April 2020.

Payment Method

The ERP payment shall be credited to the employers’ account. Employers are required to credit the payment directly to the affected employees’ accounts within 7 days upon receipt of payment from SOCSO.

Application Step

1. Please visit the website http://prihatin.perkeso.gov.my and select “Permohonan & semakan” which is application and checking application status.

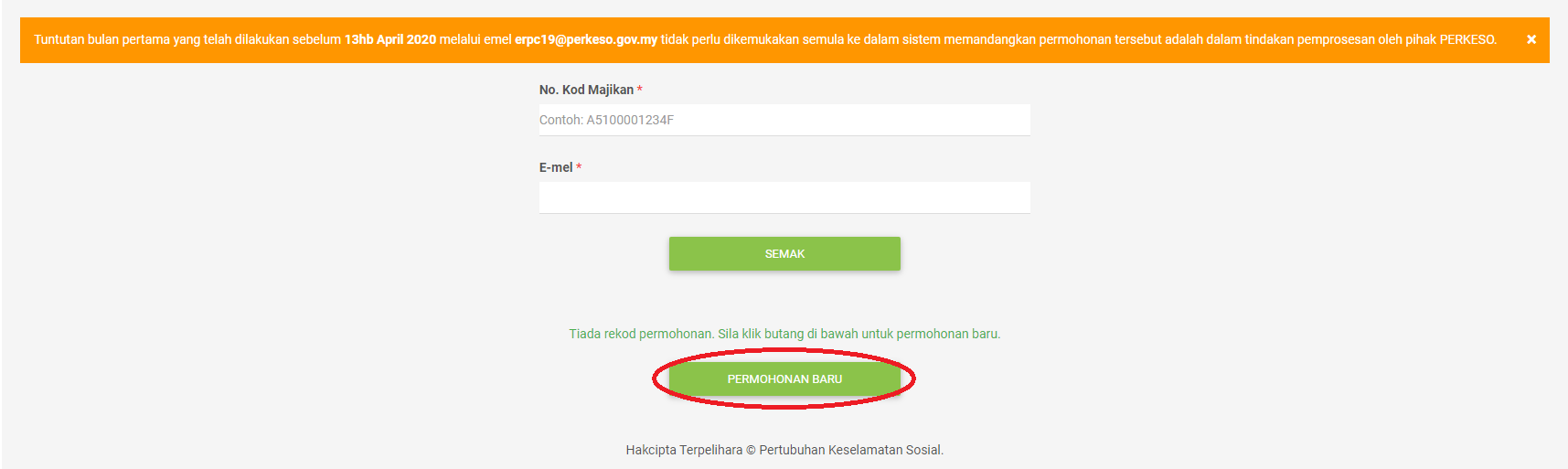

2. Fill in your SOCSO number and Email address in the blanket. Then click “Semak” to proceed.

3. If you did apply and intend to check the status, the page will direct display the information of the application.

If you are new applicant, then the page will show no record on application. Click “Permohonan baru” to do new application.

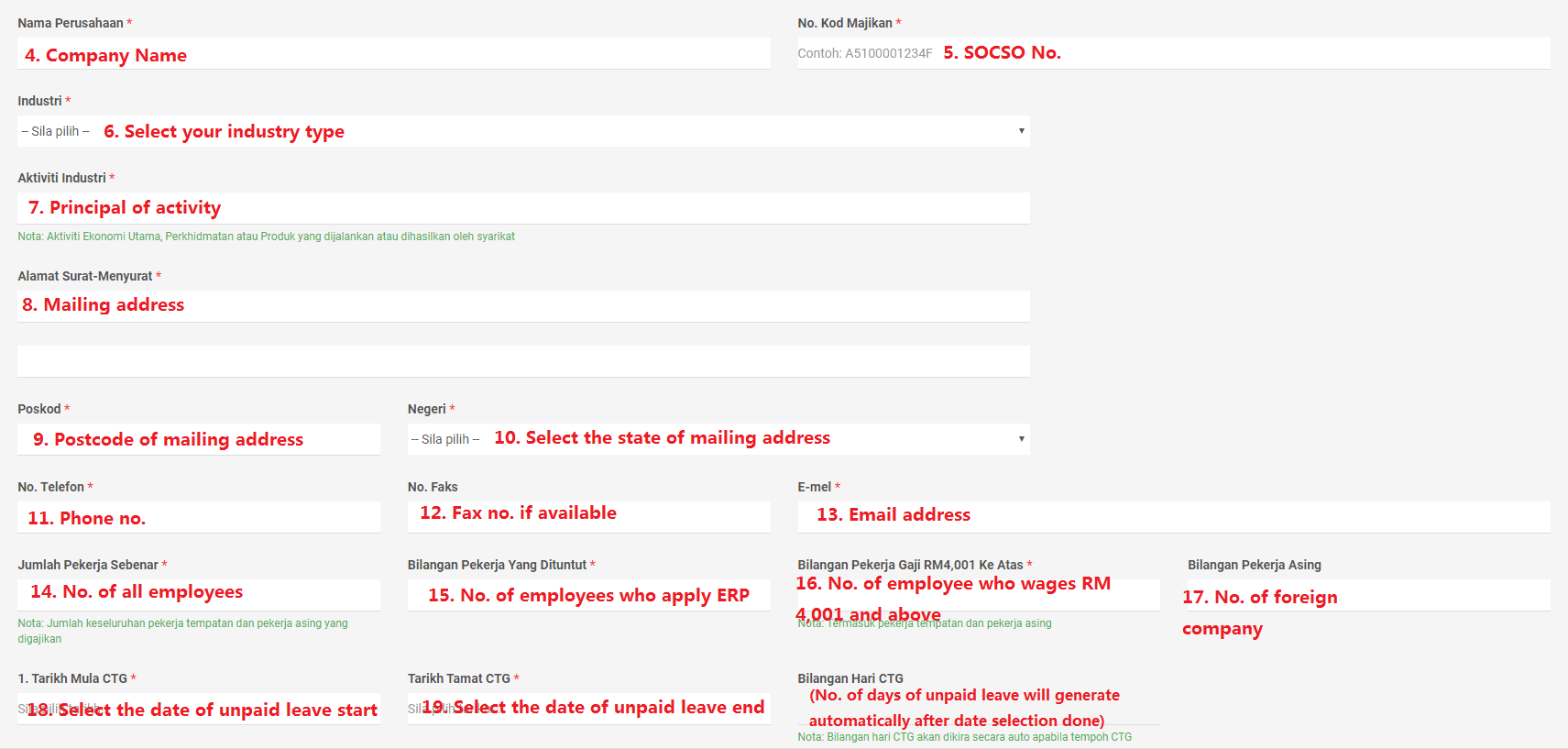

4. Fill in all employer detail that required (Section A). After filled in all details, click “Seterusnya”.

- Business registration no.

- Bank Account no.

- (Select your bank for bank account number above)

- Company Name

- SOCSO No.

- (Select your industry type)

- Principal of activity

- Mailing address

- Postcode of mailing address above

- (Select the state of the mailing address)

- Phone no.

- Fax no. if available

- Email address

- of all employees

- of employees who apply ERP

- of employee who wages above RM 4,001 and above

- of foreign employee

- Select the date of unpaid leave start

- Select the date of unpaid leave end

- Select the date of unpaid leave start

- Select the date of unpaid leave end

5. Please upload the supporting document (Section B)

22. Notice of unpaid leave letter (in PDF format)

23. (You may click to download the employee list in excel format)

24. Attachment of employee list (in excel format) *

25. (You may click to download the MyCOID / Panel Bank ID in word format)

26. MyCOID / Panel Bank ID (in PDF format) *

27. Bank statement (in PDF format)

28. Form 9 / Section 17 / Section 14 (in PDF format)

*These documents can be downloaded from the website, kindly fill up and upload to the website.

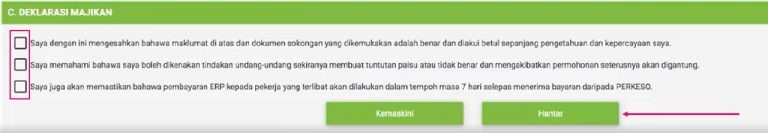

6. Tick all to the tick box and click “Hantar”.

7. Below is the display once the submission of application done. Any information regarding to the application can be checked through email. Kindly check junk box/ spam if not found in inbox.

Frequency Asked Question

The program aims to help employers affected by Covid-19 and have been instructed employees to take unpaid leave to reduce operating costs.

The ERP is effective from 1 March 2020 until a date set by SOCSO.

The Employment Retention Program (ERP) is an immediate assistance provided for employees who have been instructed to take no paid leave by their employers who are economically affected by Covid-19.

- All private sector employees including temporary employees who have registered and are contributing to EIS (Employment Insurance System).

- Limited to employees with monthly salary of RM4,000 and below.

- Employers who have implemented no-pay leave (30 days minimum) since 1 March 2020.

All applications must be submitted by the employer on behalf of their employees.

Employers who meet the three conditions can complete the application form and submit it with the list on employees with unpaid leave notice from 20 March 2020.

The employer must credit the monthly ERP payment of RM600 to the employees’ account directly within 7 days upon receipt of payment from SOCSO.

If employer failure to do so, it will subject to legal action.

Assistance paid based on no-pay leave notice period between 1 to 6 months.

No. The financial assistance is fixed at RM600 per month. The purpose of this program is to assist those employees who have lost their income (take unpaid leave) due to Covid-19 especially the tourism sector.

- Employees who have not registered with or contributing to PERKERSO

- Employee’s earning more than RM4,000

- Retired employees

- Civil servants

- Self-employed (with no employer) include freelancers

- Foreign workers and traders

For employee who is not returned to work after no-pay leave notice period, the employee will be considered as unemployed and is entitled to claim SIP Benefits.

Yes, if the employee is lay-off, the employee is eligible to apply for retrenchment benefits including job placement and retraining programs where training fees and allowances will be fully borne by PERKESO.

Unemployed employees can register with the EIS Jobs Portal to find jobs (eisjobs.perkeso.gov.my).

- Notice of unpaid leave letter, including a list of employees involved

- The employer must fill up the complete information in the Form ERPC-19 and attach with the Employer’s Circular.

This approach is to ensure that all affected employees are fully assisted and no exception. This approach is also regarded as one of the most effective practices, the verification and payment process can be shortened.

The ERP is a Government’s policy to help the low-income groups (B40 group where household income less than RM3,900) administered by SOCSO using Government funds.

The ERP program is designed to assist employers who face short-term financial difficulties due to unforeseen economic shocks, rather than dismissing employees.

This enables the company to operate after the situation recovers without the need for recruitment and training of employee.

Yes, employer can apply ERP and WSP at the same time. However, ERP and WSP shall not be claimed by same employee.

(201706002678 & AF 002133)

(201706002678 & AF 002133)